Key Considerations for Investing in an NWSL Club

The NWSL has been living through a transformational moment during this 2023 season. Expansion announcements, new leadership at the league level, record breaking attendance figures, and multiple clubs currently up for sale have contributed to a noticeable uptick in “buzz” around the NWSL from spectators and investors alike.

The NWSL offers compelling opportunities for both those involved and those still evaluating whether to join the action alongside the wave of attention this league is drawing. As the NWSL continues to grow and establish its place in the American sports market, it also faces hurdles that owners will need to recognize and address as they enter the league and grow their clubs.

Based on Sportsology Group research, we predict that the sophistication of the league will continue to increase along with ownership expectations, while the financial upside of investment into the league may also continue to grow in the coming years depending on the following factors. The purpose of this paper is to address the key considerations that require alignment from ownership in the NWSL during this period of expansion and club sales. In order to understand where the league is headed, it’s necessary to recall how the league was founded 10 years ago, and take note of its recent history.

History of the League

The NWSL is the fifth women’s soccer league to be established in the US market. It was established in the wake of previously failed women’s soccer leagues which had dissolved for various reasons; the WUSA failed to secure required financing, the USL W-League had a lack of quality among teams participating, and the WPS could not survive interminable franchisee lawsuits.

After the collapse of the WPS, the National Women's Soccer League (NWSL) was born. As a result of this collapse there was urgency around the continuation of opportunity for professional women’s soccer players in the United States which led to the league being rushed into operation. The initial product was an eight-team competition beginning in 2013. Later credited to its rushed inception, the league lacked the capital to invest in the internal structures and safety measures necessary to protect players and staff that are now recognized as non-negotiable.

As a result of a string of reported cases of serious misconduct, the USSF launched an investigation, led by Sally Yates in 2022. The investigation looked into the NWSL at a league level and on an individual club basis. The eventual Sally Yates Report articulated that the accelerated timeline to establish the league set it up for long-term challenges, such as “overlooking basic governance and policies," leading to consistent examples of poor management and governance within the league. In totality, all 10 NWSL teams before the recent California expansion have had documented cases of staff and/or ownership misconduct.

The report cited that this lack of governance resulted in “poor conditions," “lack of staff," "poor facilities," “lower pay," and “a league culture of sexual harassment and misconduct.” These have been among the many issues facing the NWSL since its inception.

In response to the extensive record of misconduct, the NWSL has turned the page, to a new chapter in its history. In the past 18 months, there have been recent efforts to reverse the damage of the league’s past with increasing requirements from teams to uphold rules, such as a revised Anti-Harassment Policy in 2023, and new league office leadership. As a product of this new chapter, there has also been movement in team ownership with an influx of sophisticated investors and an outflow of more tenured NWSL club owners.

1.0 | League Changes

On the league level, there has been a leadership reset. The league office has been filled with new personnel over the past 18 months. Most notably, Jessica Berman has taken over as the NWSL League Commissioner. Berman is highly regarded by the league's players, coaches, owners, journalists, attorneys, and the list goes on. There is a common belief running through the veins of the NWSL that they have the right leader in place to take the league to the next level. The optimism around the league office leadership comes from initiatives in the past year that are helping this new group accelerate their mission:

League independence

As of 2021, the NWSL is no longer governed by the USSF. This gives the league governors more control over strategy and spending decisions. It is also seen as advantageous for the league to have its independence as it no longer has to share resources or be “one of many” responsibilities of a larger organization. The association model is a common critique of the WNBA as some see that the league has been held back by having to share resources with the largely revenue-driving NBA. A similar model exists in European women’s football leagues which also operate jointly with the men's side.

New safety policies and regulations

The expectations and processes around managing player and staff safety are higher than they once were in the NWSL. The level of scrutiny on player safety has increased, and there are now expectations from the league office, the media, and personnel within the NWSL to bring an end to any further misconduct.

Focus on professionalization of the league

From soccer operations to commercialization, the league has taken steps to professionalize itself. The league office has tripled their marketing staff and grown their operations and HR departments steadily over the last year.

Increased expectations from club owners

The club ownership profile has shifted towards entrepreneurs and financiers with joint celebrity ownership feeding into the commercialization of the league. Examples of celebrity investment include Patrick Mahomes with the Kansas City Current, Naomi Osaka with the North Carolina Courage, and the full roster of celebrities in Los Angeles, all with a piece of the Angel City FC pie.

Through turnover in the last 3-4 years, the new owners in the NWSL have more capital and higher return expectations than that of previous club owners. This has been driven by strategic league decisions including a growing expansion fee (and more robust expansion process), increase in cap calls, and higher player salaries.

2.0 | Current State of the League

With the introduction of these initiatives, new potential has been unlocked for the NWSL. As the league works toward reaching its potential, and possibly beyond it, it will continue to be challenged as any high-growth leagues are.

2.1 | Professionalization and Financial Progress

In the last year, the league has seen increased professionalization and financial progress. Coupled together, these indicate a positive trend in commercial growth. This has led to new expansion teams, ownership groups, and expectations.

Team Profitability

Much of the investment buzz around purchasing teams that are for sale or going down the expansion route is caused by the valuations of existing teams. There have been teams successfully reaching profitability. Most notably, Angel City FC reached profitability in just two years of the expansion club’s existence. The leadership of Angel City, including its highly engaged owners, have taken a non-traditional team marketing approach establishing a mission-driven and community-based sports brand. The club has been valued at $100M now three years in.

While not every club can replicate Angel City’s market, the Portland Thorns are another example to look at. Before the COVID-19 pandemic began in 2020, the club had managed to achieve profitability (near break-even). This is largely believed to be accredited to their on-pitch success driving fan engagement. From Sportsology Group research, the other 10 active teams have not been profitable or reached break-even to this point, and are still making strides toward reaching profitability with an average burn rate of $3-6 million annually.

Financial Drivers

Many of the commercial numbers shared on social media across attendance and viewership have been trending upwards in this 2023 season. Through Sportsology Group research, we analyzed how the following drivers will contribute to financial success for clubs:

Club Commercial Revenue Growth - Viewership and attendance has been on the rise for women’s sports, and the NWSL has the highest average attendance figures when compared to other women's soccer leagues and the WNBA.

Viewership - Although the NWSL's 16% of total games televised is not the lowest among women’s football (Liga F in Spain at 12.5%), the NWSL offers the fewest number of opportunities for match advertisements and sponsorships. Still, viewership has also been trending upward with a record breaking 915,000 viewers for the 2022 final between the Portland Thorns and Kansas City Current. This trend has continued so far this 2023 season, as the league broke their own record for opening weekend attendance (48% increase from last year), and had the most watched regular season game ever (415K).

Attendance - The NWSL is breaking its own single-game records of attendance as well, with regular season matches reaching up to 32,000 tickets sold. The league feeds off of this momentum for additional growth. Each time a club breaks their home game record, the league announces it on their social media to advertise to potential sponsors and broadcasting partners the numbers that NWSL clubs are drawing.

Invested Ownership Groups - Owners in the NWSL have been actively participating in growing the women’s game. A key example from the last few months are newly introduced women’s sports multi-asset investment groups. Michelle Kang has been the “poster child” of women’s sports investment. She is the owner of the Washington Spirit, and made a recent acquisition of the women’s side of Olympique Lyonnais. Similarly, Kara Nortman of Angel City FC recently announced Monarch Collective, a women's sports fund taking her investment experience and network to the women’s sports market. The message the market has gotten from these strategic moves is that, “women’s sports are their first and sole priority” with anticipation that this will be reflected in club operations as well.

National Notoriety - The NWSL is comprised of 60-75% domestic players, and all but one player on the USWNT play in NWSL. The 2023 Women’s World Cup is seen as an important indicator to establish the total addressable market (TAM) for the league to leverage in negotiations for their upcoming broadcasting deal. It is also seen as a catalyst for establishing a new set of “heros” for American youth, establishing fans who will grow with the league. This has been seen to be the case with USWNT stars like Alex Morgan (San Diego Wave) and Megan Rapinoe (OL Reign) in previous Women’s World Cups and Summer Olympics years.

League Broadcasting Deal - The new broadcast rights agreement in negotiation has high potential, which could eventually support the financial security of the league. With the current broadcast rights agreement in negotiation, the NWSL will most likely utilize momentum created by the 2023 Women’s World Cup and its rising attendance / viewership numbers to rake in a deal estimated at 8x the worth of the current contract. Given comparable league TV deals across the US sports landscape, we would expect that the next NWSL deal negotiated should be worth $10-15M annually (estimated 8.2x the current deal value).

Club Sales - There are currently three NWSL clubs on the market. Chicago Red Stars, Portland Thorns, and OL Reign. The price tag on these clubs have variable valuations based on club reputation, staff, facilities, and their local markets. Given recent entrants into the league, via both expansion and club acquisition, we would expect this new set of owners to continue to improve the level of financial and management sophistication within this league. What price these franchises ultimately transact for, and how those amounts compare to the most recent expansion fee, will be a further indicator of the league’s current momentum.

Expansion Teams - When Sixth Street committed to a $53M expansion fee earlier this year (more than 10x higher than the $5M reportedly paid by the KC Current in 2020) to bring a club to the Bay Area (Bay FC), it became the first known example of a fully majority private equity-owned team amongst the Major 5 US leagues and the NWSL. Including building facilities and start-up costs, Sixth Street has declared an overall upfront investment of $125M into Bay FC (planned to start play in the 2024 season). Jessica Berman has stated that the league will add “two more teams for the 2026 season,” and that they have multiple interested investors bidding to enter the league. Adding additional teams to the league at a $53M+ expansion fee would most likely eliminate or largely reduce cap calls for existing owners, so funds can be spent elsewhere with their clubs.

It is also notable that the NWSL brought on Inner Circle Sports, a sports-dedicated investment bank to run their expansion process last year. Inner Circle Sports has been able to equip the league with structure and a clear process for expansion. This has not been the case for other women’s leagues, including the WNBA which has consisted of 12 teams since 2010.

2.2 | Continued Growing Pains

Along with these opportunities, the NWSL also faces both new and persistent obstacles that we consider to be risks for investment.

Culture / Reputation of Teams

There is a “zero margin for error” around player safety and staff misconduct at all levels within organizations at this point in the league’s history. It has been said during Sportsology Group interviews that the “league could not survive another Yates Report.” While some teams have not been able to fully turn this page as they remain for sale, there is still the shadow of the league’s recent history remaining.

As retribution for the misconduct of the recent past, there have been cases where players have even been involved in GM and Head Coach decisions within their clubs. While the level of involvement players have had is inconsistent in these cases, it is important for ownership and management to understand this precedent in the league, and be able to properly engage with players and staff within this culture and environment.

"Start-up" League

The NWSL is a relatively new league, and although it has shown growth, it is still considered a start-up or high-growth league (which can come with its own set of risks). Given the league reset last year, the core league office staff - while perceived to be capable - have only held their positions for between 6-20 months. More time will tell if the safety regulations and new league infrastructure can foster the league’s growth at its current rapid rate while mitigating the challenges of its past.

Popularity of Football in Europe

Women's soccer is increasing in popularity in Europe as well (as highlighted by the viewership numbers from last year’s Euros), and currently, more of the world’s top ranked players are playing for the leading European clubs. Some players may prefer to play in European leagues if the NWSL cannot keep up with the rise of player salaries. This could make it difficult for the NWSL to attract top global talent. Additional criteria that impacts a player’s decision to change clubs/leagues include the quality of facilities, head coach, visibility, benefits, etc. While this has not yet presented a major threat to the NWSL as most of the US players who have left the NWSL for Europe have then returned after only one or two seasons of play, it could impact ownership spend and player quality in the future.

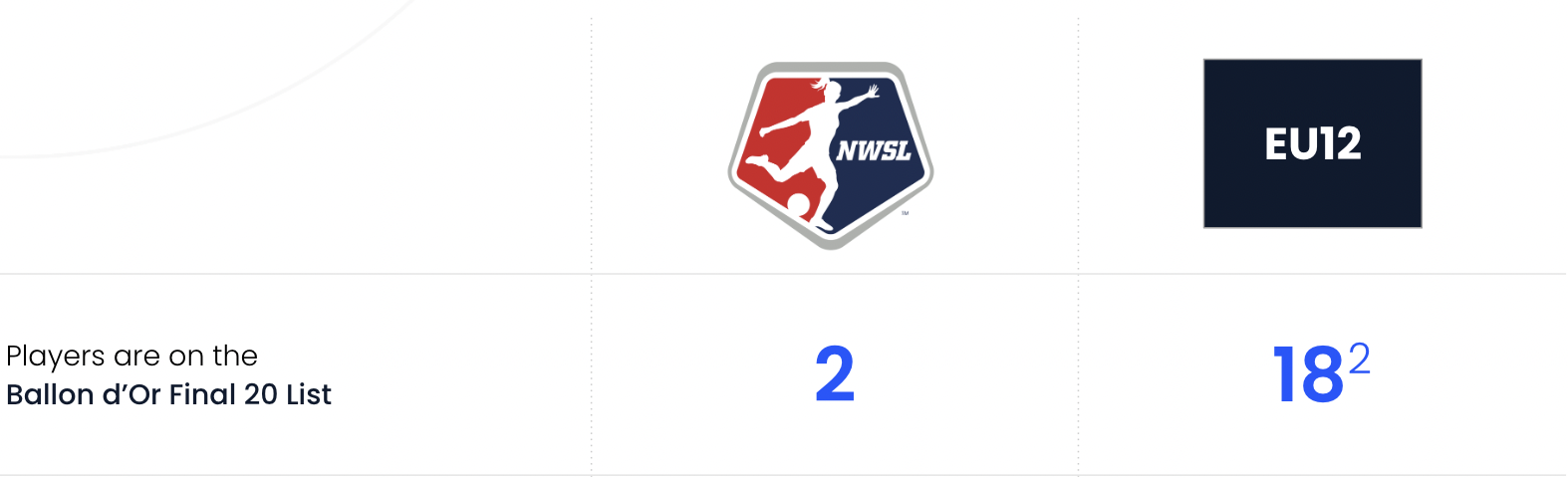

NWSL and EU12 Player Quality Comparisons

There is a similar challenge when it comes to head coaches. In the EU12, 80% of Head Coaches have Pro Licenses whereas only 37% of NWSL Head Coaches have them. As the league scales, the demand for head coaches will increase as well, possibly reducing this percentage further if coaches are not developed or appropriately incentivized to coach in the NWSL.

Announcement of USLS as Division 1 League

The USL announced in the last few months their intentions to create a Women’s Super League (USLS) planned for 2024. The USLS, while initially announced as a Division 2 league, has now publicized its plans to enter the US market as a Division 1 league. While the results of sanctioning for a D1 license are still pending, there are notable risks to the NWSL should the USLS succeed.

If the USLS is able to attract NWSL talent through pay, facilities, etc, the leagues would be competing for talent within the same US market. This could lead to an increase in the NWSL salary cap to keep top talent engaged, or the league could start demanding a higher standard from ownership (e.g. training facilities, stadiums) to keep talent coming to the NWSL. However, it should be noted that the USLS has not committed to a specific salary cap or salary minimum at this point, and the average assets under management (AUM) of USLS owners is not as high as that of the average NWSL owner, so it is unclear if the USLS will be able to compete for talent through player salaries regardless of their division.

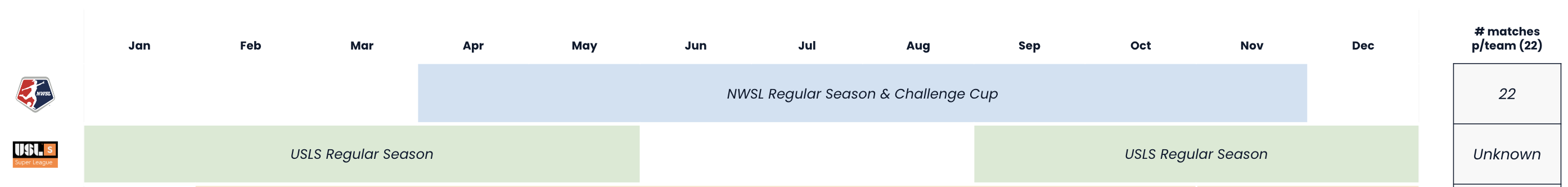

The USLS has also announced its season structure would mirror that of the European football calendar, which is notably different from the NWSL’s season calendar. In theory, the USLS’s calendar makes it easier for international talent to play with their national teams given the alignment of FIFA recognized international windows. This will allow more international talent to play in the USLS without conflict, a common critique of the NWSL model.

NWSL and USLS Season Schedule

The other differentiating factor is the player pathway of the USLS, unlike the NWSL which relies on a draft, the USLS has an existing academy system from youth to pre-professional that would feed directly into the Division 1, USLS.

These considerations paired with the additional expansion teams in the NWSL, present a chance for player quality dilution in the league if the NWSL cannot establish its own player pathways or attract sufficient international talent.

Ownership Archetype Change

The new owners in the league, as explained above, are perceived by some to be a positive sign for the league. Others could also note that the majority of these owners are new to the game being first-time sports franchise owners, and with three teams for sale, there is a risk around the unknown. There have not been any announcements of new owners for the Portland Thorns, OL Reign, or the Chicago Red Stars, but who ultimately fills these three seats at the governors table could also impact the leagues trajectory.

Questions remain about the financial sustainability of the teams in the league, the fact that one-fourth of the league is currently up for sale, and how a notably domestic-reliant player and staff pool will be affected by further expansion teams and potential rival leagues. Jessica Berman and her team will have her hands full in the coming seasons as they try to tackle these key issues. The agreement for a new media rights deal and conclusion of the multiple franchise sales processes, both of which are expected to be done by the end of this year, will provide indicators to potential investors for the longevity of the league’s current momentum.

3.0 | Key Considerations for Investment in the NWSL

Knowing what we’ve outlined with regards to the headwinds and tailwinds for the league, there are six key factors that we believe to be most important when considering investing into an NWSL expansion team, or in growing an existing club.

Facility infrastructure: When entering the league, the club should have access to a suitable stadium with the necessary amenities and infrastructure to host professional soccer games. We foresee the NWSL increasing its stadium requirements in the future. Collegiate stadiums may no longer be suitable for NWSL teams unless it is a short-term solution operating alongside a longer term plan. Leasing or building a stadium are both viable options. For training facilities, having a facility solely dedicated to the NWSL club is the recommended route. The investment in building a training facility should be accounted for in the upfront investment cost.

Ownership and financial stability: The team should have a committed and financially stable ownership group that can sustain the team's operations and invest in player development and community outreach. While there will likely be fewer cap calls given the inflow of expansion fee payments to the league, owners will need to provide continued investment into the operations of the team. It is foreseeable that increasing investment expectations and player costs will outpace revenue growth potential in the short term as the league scales. Profitability (beyond Angel City as an outlier) should be examined on a 10-15 year outlook.

Player pool and development: Player development will be important overtime as the risk of talent pool depletion lingers. Rapid team expansion and the possibility of a new Division 1 League (USLS) competing for the same talent could dilute the overall product lacking the same quality of staff and players.

Market size and demographics: The market should have a large enough population to support a professional women's soccer team, as well as a diverse and engaged fan base. The team should be able to develop strong local partnerships with community organizations and possibly other professional sports teams in the area to help grow the team's fan base and support.

Culture of Player Care: The ownership and staff will need to have the knowledge of the past failures of the league that pertain to player safety, and be committed to the modern league standards. We believe that without aligning staff with this culture and the value behind protecting the safety of personnel, there is high reputational and financial risk for club and ownership.

Conclusion

The NWSL is creating its own path to success rather than replicating leagues before it. It is a unique league to the sports market. It’s a women’s league that is being driven by female leaders without a partner men’s organization to split resources with. However, it is par for the course when trailblazing, that there will be obstacles, and the NWSL’s path forward will be no exception.

The league has broken multiple viewership and attendance records, introduced improved policies and standards to protect its players, and pioneered a PE-owned franchise model with an expansion fee that the league’s own owners couldn’t even believe. All this under the leadership of a brand new commissioner and executive management team that is very well-respected within the industry.

The league has high expectations for new owners both when it comes to financial commitment, and also when it comes to cultural fit. The ownership group in the NWSL governs in a different way than other professional US sports leagues with its mission-centric approach. This group isn’t begging for owners to join them, it is hand picking the best partners to help drive their movement forward. Nonetheless, if these six considerations are properly aligned there is substantial potential for success.

Authors: Emma Schilling, Pien Gillhaus, George Gallagher, Sam Westbrook, and Luke Casey-Leigh

If you are interested in speaking to one of our NWSL experts, please submit your information below, and we will follow up.